Use AI automation to streamline 1040 tax planning and research, automate emails and client workflows to improve client relationships & uncover tax-saving strategies. CPA Pilot is a Research-first AI Tax Associate with verifiable data, built For Scalability & Accuracy. Save hours and deliver smarter with AI Tax Copilot built specifically for U.S. tax practices.

10+ Hours Saved Per Week | 3X More Client Communication

Trusted AI Copilot for 6,000+ Tax Professionals — CPAs, EAs & Advisors Nationwide

Join the growing number of accounting firms relying on CPA Pilot: The #1 AI-powered Tax Associate built for trust, compliance, and real-world results. See how top accountants and tax advisors use CPA Pilot to prepare returns and streamline the entire tax filing experience.

Julie, UT

I’m using CPA Pilot to ensure payroll and 1099 compliance.

Mike, NY

I’ve tested CPA Pilot with 15-20 questions and it’s been spot on.

Claire, MI

This is great! It’s much more accurate than the other chat tools.

Randall, NY

Thanks for building this! It’s been much needed

Forrest, NY

Client Helper will reduce client requests by 50%

Anil, CA

CPA Pilot is amazing!

Steve, NJ

I will talk to anybody to vouch for the quality of CPA Pilot

Eduard, IL

At this price this is a no brainer

Larry, WA

I’m going to be a customer for life…

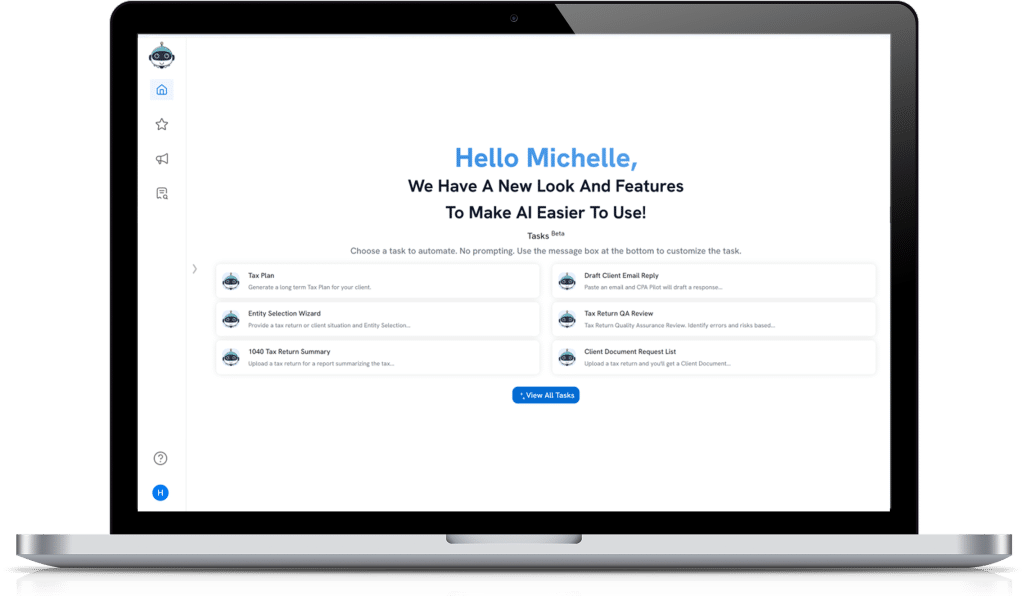

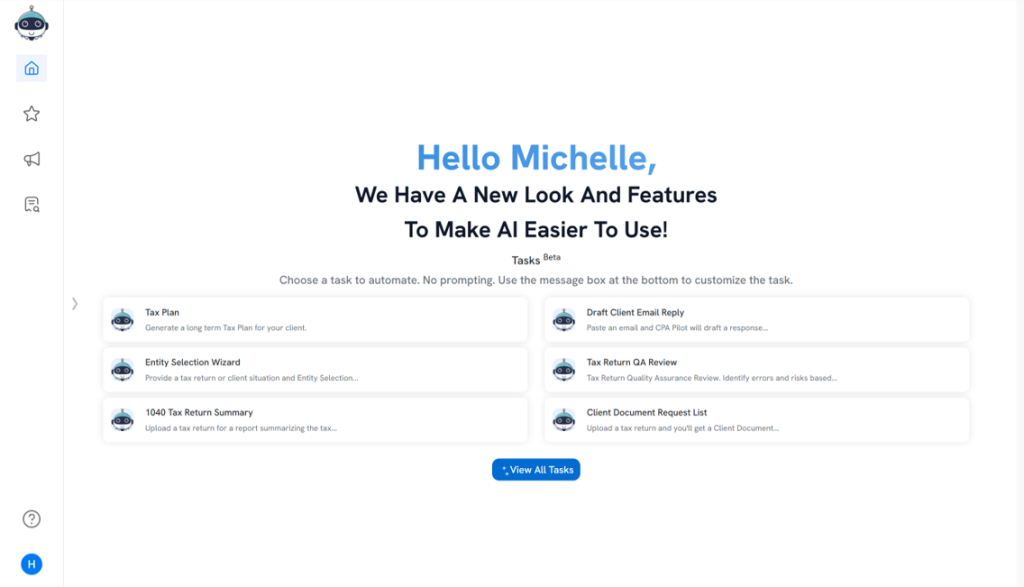

What is CPA Pilot?

CPA Pilot is an AI tax assistant built exclusively for CPAs, Enrolled Agents, and U.S. tax firms. More than just software, it acts like a digital, online tax advisor — automating tax research, tax projections, drafting client emails, generating marketing content, and onboarding new staff.

Whether you’re planning complex tax scenarios, fielding client questions, or scaling your practice, CPA Pilot makes ai tax preparation faster, smarter, and stress-free — so you can focus on what matters most.

CPA Pilot Vs Top AI Tax Planning Tools

Smarter than ChatGPT. Faster than Blue J. More affordable than TaxGPT.

~

“CPA Pilot is an AI copilot for tax professionals — smarter than generic AI tools like ChatGPT and more practical than research-only platforms like BlueJ. Here’s how we stack up against common tax planning tool alternatives:

CPA Pilot 🆚 ChatGPT / TaxGPT:

“I didn’t like the format of the answers TaxGPT provides. It requires a full-year subscription and is expensive for my whole team to use.”

CPA Pilot gives you tax-accurate answers — cleanly formatted, sourced, and ready to share with clients. No prompt engineering needed. And now offers more than just tax research.

CPA Pilot 🆚 Blue J Tax:

“BlueJ Tax only provides tax research and requires you to keep digging to get the answer. Meant for someone who enjoys doing tax research, not for a quick answer.”

With CPA Pilot, you get step-by-step guidance, chatbot-powered software instructions, and automation tools to generate import files — all in seconds.

💰 How is CPA Pilot More Affordable Than Other AI Tax Tools?

Our usage-based pricing means your entire team can access CPA Pilot for less than the cost of one license from most competitors.

6000+

Tax Professionals, CPAs & Enrolled Agents

200,000+

Questions Answered

Trusted by CPAs, Tax Attorneys & Tax Firms in The U.S

Why Tax Professionals Choose CPA Pilot — The Agentic AI Assistant?

→ AI for Tax Research and Strategy

Instantly cite IRS codes, draft memos, and answer complex tax questions.

→ AI Chatbot for Tax Professionals

Automate client emails with professional, IRS-cited replies.

→ Agentic AI for Complex Tax Tasks

Create a tax plan or tax return summary in seconds.

→ AI for Tax Content Creation

Generate niche marketing content and social media posts.

Join 6,000+ Tax Pros Who Use CPA Pilot

Join the growing number of tax professionals using CPA Pilot — built for trust, compliance, and results.

Bill Opaska

Jan 24, 2024

AI for the small practitioner CPA & EA Firm

CPA Pilot has made our small CPA – EA better by providing information vital to our clients at our finger tips. We are able to draft instructional letters and emails just by asking questions. The time we are saving is enormous. This is definitely what the small practitioner needs.

Daniel Skipworth

Jan 25, 2024

CPA Pilot is invaluable!! 💣⚡🚀

CPA pilot has been an invaluable tool in helping jumpstart various projects and a quick reference tool available on the fly during a call.

TJ

Jan 24, 2024

We have saved some much time

We have saved some much time. We are so thankful for CPA Pilot!! Thank you.

Sheila

Jan 24, 2024

Best program ever!!

Best program ever!!! I don’t know how I ever lived without it.

AI for Tax Professionals - Real Use Cases That Save Hours

AI for Tax Research & Planning

Deliver accurate, citation-backed answers to federal and state tax questions using IRS publications, court rulings, and state codes.

AI for Tax Projections

Run detailed what-if scenarios and generate client-ready summaries using U.S. tax strategy logic and real-time code interpretation.

AI Chatbot for Client Communication

Draft professional, IRS-aligned replies to client emails instantly — from extensions to status updates — in plain, shareable language.

AI for IRS Notice Responses & Compliance

Generate compliant responses to CP2000s, CP2501s, and other IRS notices with clear explanations and citations to IRS source material.

Designed for the Seasonal Demands of Tax Practices

Every plan includes access to CPA Pilot – your AI copilot for tax preparation, client emails, IRS notice responses, and staff training.

- Perfect for solo CPAs and larger teams. Monthly Plans from just $20/month. Includes rollover messages, so you don’t lose what you don’t use as long as you have an active subscription.

- Built for seasonality – Get all your messages upfront — use them anytime, share with your entire team, and enjoy the lowest effective cost per message.

- Built for sharing – Account sharing is allowed with all plans except the unlimited plan.

Upgrade or Downgrade as usage changes.

No annual commitment required.

CPA Pilot 20

Dip your toe into the water and see how much better your firm is with CPA Pilot

$19/Per Month

- 20 messages/month

- 7-Day Free Trial with 20 messages

- Unlimited Devices

- Rollover Messages

- Annual Plan: 240 Messages Upfront

CPA Pilot 60

Most popluar plan. Scratching the surface of what CPA Pilot can do.

You want to use CPA Pilot to for more than research. From email replies and tax plans to automating data entry for tax returns.

$49/Per Month

- 60 messages/month

- 7-Day Free Trial with 20 messages

- Unlimited Devices

- Rollover Messages

- Annual Plan: 720 Messages Upfront

CPA Pilot 150

For power users and small teams sharing an account. Yes we are okay with that!

$119/Per Month

- 150 messages/month

- 7-Day Free Trial with 20 messages

- Unlimited Devices

- Rollover Messages

- Annual Plan: 1800 Messages Upfront

CPA Pilot Unlimited

Because you don't like restrictions. Meant for 1 user.

$199/Per Month

- Unlimited messages For Power Users

- 7-Day Free Trial with 20 messages

- Limited to 1 user and 3 Devices (No account sharing)

CPA Pilot 20

Great for a solo tax practice if you are only using it for tax research.

Get 240 messages upfront so you can use them when you want.

$200$240

/Per Year

- 20 messages/month

- 7-Day Free Trial with 20 messages

- Unlimited Devices

- Rollover Messages

- Annual Plan: 240 Messages Upfront

CPA Pilot 60

Get 720 messages upfront and use CPA Pilot to automate daily tasks from email replies to tax return data entry

$499$588

/Per Year

- 60 messages/month

- 7-Day Free Trial with 20 messages

- Unlimited Devices

- Rollover Messages

- Annual Plan: 720 Messages Upfront

CPA Pilot 150

Great for Super Users and teams who want to share an account.

Get 1800 conversations upfront.

$1199$1428

/Per Year

- 150 messages/month

- 7-Day Free Trial with 20 messages

- Unlimited Devices

- Rollover Messages

- Annual Plan: 1800 Messages Upfront

CPA Pilot Unlimited

You want to leave CPA Pilot open all day and use it as your right hand and maybe be your nerdy tax best friend that you've been looking for all your life.

$1999$2388

/Per Year

- Unlimited Messages for Power Users

- 7-Day Free Trial with 20 messages

- Limited to 1 user and 3 Devices (No account sharing)

Frequently Asked Questions

What Can CPA Pilot Help Me With?

CPA Pilot helps you save hours of manual work by automating tax research, drafting emails, creating marketing content, and answering client questions.

It integrates directly with IRS and State tax sources and supports technical workflows across major tax software platforms like Drake, Lacerte, UltraTax, and ProConnect.

You can:

Instantly access IRS and State forms, publications, and tax codes

Get step-by-step instructions for complex tasks

Automate content creation in your niche

Respond to clients in seconds with professional, clear answers

How Accurate Is CPA Pilot Compared to ChatGPT?

CPA Pilot consistently outperforms general AI models like ChatGPT in tax-specific use cases.

In a test using CPE-level tax questions:

ChatGPT got 55% correct

CPA Pilot delivered 98% accuracy

This performance is achieved by:

- Using only authoritative sources (IRS, State codes, tax software docs)

- Citing every source used, so you can verify instantly

- Training specifically for tax scenarios, law interpretation, and 1040 guidance

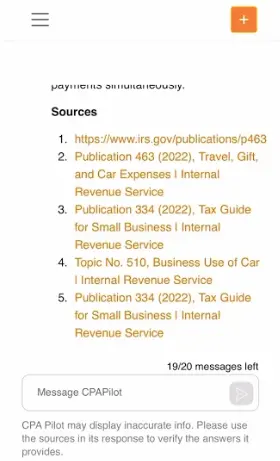

What Sources Does CPA Pilot Use for Tax Research?

CPA Pilot pulls from verified, up-to-date, and jurisdiction-specific tax documentation including:

IRS Website and the Federal Tax Code

State Tax Codes and official websites for all 50 states

IRS Instructions, Publications, and Forms

State tax agency documentation, forms, and publications

Technical support docs for: Drake, Lacerte, UltraTax, ProSeries, ProConnect, and QuickBooks Online

You always see cited sources with each answer — including links and publication dates.

Does CPA Pilot Replace Customer Support for Tax Software?

Yes — CPA Pilot acts like an AI-powered technical support assistant.

Instead of calling software vendors or browsing forums, you can ask CPA Pilot for:

Setup steps

Workflow help

Troubleshooting guidance

File import/export instructions

It’s like having Lacerte or Drake support built into your practice.

Can CPA Pilot Give Incorrect Answers?

While CPA Pilot uses the most reliable AI models and sources (like GPT-5, 4o), no AI system is perfect. Here’s when errors may occur:

Missing official guidance: No documentation exists for edge cases

Misunderstood prompt: You can clarify or rephrase

Wrong tax year pulled: Easily fixed by specifying the year

Numeric extraction errors: Sometimes misreads deduction limits from scanned docs

We encourage reporting any issue to [email protected]

Does CPA Pilot Cover All State Tax Codes?

Yes — CPA Pilot includes:

Complete tax codes for California and various all other U.S. states.

Most official documents, webpages, and forms

Regular updates to reflect policy and form changes

What Happens If I Run Out of Messages?

You can purchase additional message credits anytime.

Messages never expire as long as your subscription is active

All message-based plans include monthly rollover

Team-wide sharing is available on annual plans

How Does CPA Pilot Integrate With My Existing Workflow?

CPA Pilot plugs into your current tech stack by:

Working alongside your existing tax software

Automating email responses and internal communications

Generating import-ready files to reduce manual data entry

No need to change tools — just work smarter with AI.

Can CPA Pilot Help With IRS Audit Response or Tax Notices?

Yes — CPA Pilot can:

Draft professional responses to IRS CP2000, CP2501, and other notices

Help interpret penalty codes, adjustments, and payment options

Cite IRS publications and instructions for each response

Is CPA Pilot Secure for Client Data?

CPA Pilot follows best-in-class data protection standards and is building toward SOC-2 compliance.

No client data is stored unless explicitly provided for upload-based features (coming soon). All interactions are encrypted.

What are all the use cases CPA Pilot can help my firm with

CPA Pilot is your AI-powered assistant for tax professionals, designed to help you research faster, communicate better, and review client data more accurately — saving hours every week during busy season.

Tax Research & Technical Accuracy

Instantly answer federal and state tax questions with authoritative citations (IRS, IRC, Treasury Regs, DORs, and Tax Court rulings).

Summarize new IRS guidance, court decisions, and state-level tax updates.

Compare entity structures and state tax treatments (e.g., S-Corp vs LLC vs C-Corp).

Draft defensible research memos and position summaries for client files.

Identify relevant code sections, form line items, and IRS publications.

Turn complex tax law into plain-English explanations your clients can understand.

Tax Planning & Projections

Run what-if scenarios (e.g., entity election, maximizing deductions, or adding dependents).

Estimate federal taxes and quarterly payments accurately.

Compare baseline vs alternative projections side by side.

Model QBI deductions, depreciation, TCJA sunsets, and payroll strategies.

Generate client-ready summaries that clearly show tax savings.

Tax Return Review & Data Preparation

Upload Profit & Loss statements (PDF or Excel) and automatically convert them into structured import files ready for use in tax software.

Upload W-2s, 1099s, 1098s, K-1s, and other personal tax documents for AI-assisted quality reviews — flagging potential errors, inconsistencies, or missing data.

Check for income mismatches, duplicate entries, and unusual variances.

Produce review summaries and client-ready feedback reports to streamline quality control.

Client Communication & Email Drafting

Automatically draft responses to client emails directly inside Gmail.

Suggest ready-to-send replies for tax questions, document requests, or follow-ups.

Forward or delegate emails automatically using AI-based routing rules (e.g., “Send to preparer,” “Send to admin”).

Draft IRS notice explanations, status updates, or tax advice summaries in a clear, professional tone.Marketing & Content Creation

Write SEO-optimized blog posts, social media updates, and email newsletters tailored for your clients.

Create video and webinar scripts to explain complex topics simply.

Repurpose content into LinkedIn posts, website articles, and Google Business updates to grow your online visibility.

Compliance & Documentation

Generate IRS response letters, reasonable compensation analyses, and tax position memos using professional built-in tax resolution templates.

Draft client disclosures, information request templates, and summary reports automatically.

Ensure documentation is clear, compliant, and defensible for audits or client files.

In short:

CPA Pilot helps your firm:

Research faster — with authoritative sources you can cite.

Communicate better — drafting and routing emails automatically.

Review smarter — by analyzing P&Ls, W-2s, 1099s, and other documents.

Prepare efficiently — converting P&Ls into import-ready tax files.

Resolve issues confidently — using built-in professional tax resolution templates.

Market effectively — with automated content that drives new clients.