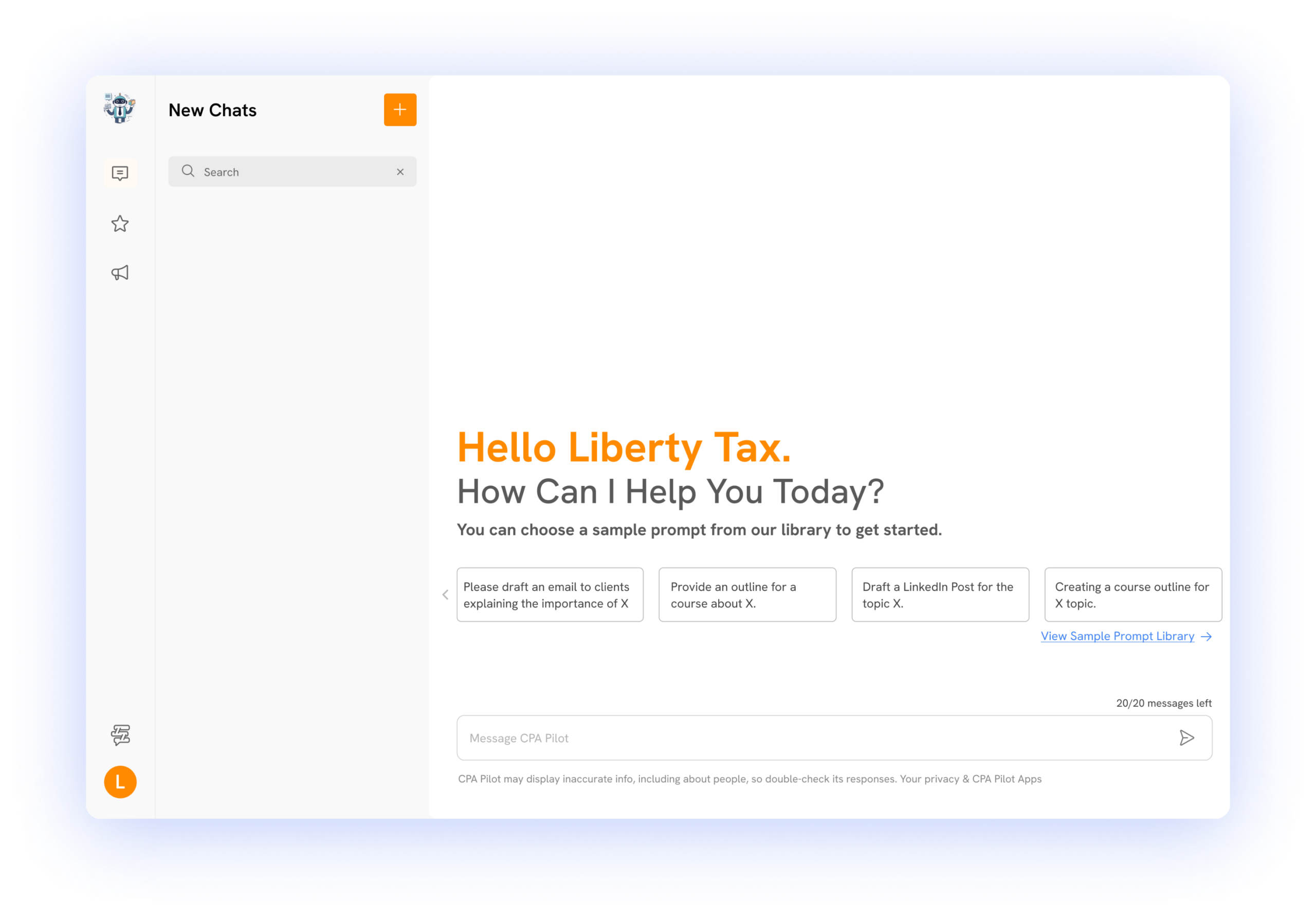

Most Common Use Cases:

to work faster, grow your firm, deliver more value to your clients and give them the best client experience.

David Dulaney, Tax Attorney

“CPA Pilot is the fastest and most accurate way for me to communicate the right answer to my clients.”

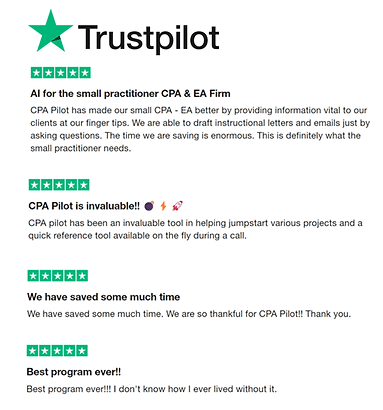

We are top-rated on Trustpilot.

Liberty Tax Exclusive Deals!

3-Year Price Guarantee

LT CPA Pilot 60

For Average Usage

LT CPA Pilot Unlimited

Limited to 3 devices

Try risk-free! If you’re not satisfied, get a full refund within the first 7 days.

Only answers from vetted authoritative sources. Answers include the sources used to answer your questions

Uses GPT-4o the best AI available

Includes support documentation for most tax software for instant tech support answers

Let's explore the possibilities together.

Smart, Convenient and Low Cost

24/7 365 days and never gets tired. We trained CPA Pilot to give high quality advice.

Never out of date

We update CPA Pilot’s knowledge regularly with authoritative sources so it gives you the best answers. Premium includes most state and federal tax codes.

Better than ChatGPT

Because we gave our CPA Pilot access to the authoritative resources, it is really great at explaining technical and complicated tax situations. Making it the best client communicator and assistant.

Make better strategic decisions

CPA Pilot has the entire tax code at its finger tips so you can identify the best strategic decisions for your clients. Tax planning becomes really interesting. We’re building more here. Be sure to subscribe so we can keep you in the loop!

About

Made for Tax Pros by Tax Pros

CPA Pilot’s mission is to make the lives of tax professionals easier, happier, and more fulfilling through the use of AI.

From The Founder

“CPA Pilot is personal for me. My father is a tax preparer and has run his tax practice out of our basement since I was 5 years old. Like many accountants, he worked himself into a heart attack at 54. He is 81 now and still working. At 14, seeing my father in the hospital left an imprint on our entire family. My sister became a cardiologist and I became a CPA. I entered the tax profession with the hope of helping my dad slow down and built CPA Pilot for myself. With the amount of time I was saving I had to share it with others in my profession. I released it to the public in October 2023.”

–Harsh Mody

Frequently Asked Questions

Why not use ChatGPT with web browsing instead?

2 very important reasons:

It’s much slower than CPA Pilot. We can provide you an answer in seconds while ChatGPT with web browsing takes minutes.

The sources ChatGPT may use are not necessarily authoritative source. It may pull some info from Nerd Wallet or Forbes. It’s like a doctor using WebMD to diagnose your health issues. We only use authoritative sources like the IRS and the tax code.

Does CPA Pilot hallucinate?

All current AI tools using Large Language Models, like ChatGPT hallucinate. We go above and beyond to minimize hallucinations.

We tell our AI to only rely on authoritative information to provide you the best possible answer.

On rare occasion, CPA Pilot may give you a wrong answer, because:

- We may not have a source that provides guidance on the situation you are researching. If this is the case, please email us at [email protected] so we can add the appropriate source.

- CPA Pilot misunderstood your questions or request. In this case you can clarify your question or tell it the answer is wrong.

- CPA Pilot may pull some information from the incorrect year. You will see the source documents are from a different year. You can tell it to pull information from the year related to the situation you are investigating.

- CPA Pilot sometimes has trouble pulling numbers from documents. We are working to make this better. It is much better at helping you interpret rules than it is for looking deduction amount limits.

What state tax codes are included in CPA Pilot?

CPA Pilot has access to the tax code for all 50 states and most of the webpages, documents, forms, instructions and publications for CA, NY, NJ, PA, MD, DC, FL, TX and IL. We are adding resources to make your job easier on a regular basis.

Why would I want Client Helper on my website?

Having Client Helper as a section on your website allows your clients to ask it questions that they would normally call or email you about.

This will save you a lot of time and clients feel like they are getting better service by not having to wait for an answer.

Client Helper uses simplified wording as you would when talking to your clients about taxes. CPA Pilot will use wording that is more technical in nature.

CPA Pilot

Sources:

- IRS Form Instructions and Publications

- IRS Website

- Federal Tax Code

- State Tax Code for 50 States

- Webpages, Documents, Forms, Instructions and Publications for CA, NY, NJ, PA, MD, DC, FL, and TX.

Features and Benefits:

-

Powered by GPT-4: Leverage the intelligence of GPT-4 for smarter, more insightful tax guidance beyond the basic CPA Pilot offering.

-

Precision Answers: Get the most precise and detailed explanations to intricate tax inquiries.

-

Advanced Research Capability: Tackle the most complex tax scenarios with our comprehensive research tools.

-

Optimized for Tax Experts: A tool designed specifically to augment the workflow of Tax Accountants.

-

Content Creation Simplified: Easily produce engaging newsletters and social media posts tailored for tax professionals.

-

Tailored Tax Research: Conduct in-depth research on nuanced IRS and Tax Code issues swiftly and effectively.

-

Custom Tax Strategies: Generate bespoke tax plans and strategies that align with individual client needs.”

-

Effortless Access to Authoritative Tax Resources: Navigate tax complexities with instant access to official IRS forms, publications, and articles.

-

Streamlined Tax Communication: Craft comprehensive emails addressing intricate tax matters within moments.

-

Expand Your Insights: Benefit from unlimited character responses for a thorough analysis.

Client Helper

Make CPA Pilot available on your website so your clients can get immediate answers to their questions and reduce client request and questions.

Sources:

-

IRS Form Instructions and Publications

-

IRS Website

Features and Benefits:

-

Reduce Client outreach and requests by as much as 50%

-

Powered by GPT-4: Leverage the intelligence of GPT-4 for smarter, more insightful tax guidance beyond the basic CPA Pilot offering.

-

Precision Answers: Get the most precise and detailed explanations to intricate tax inquiries.

ChatGPT

While we use the same technology, GPT-4, there are some significant differences between ChatGPT and CPA Pilot.

ChatGPT can search the web for your answers. If it does search the web, it will likely take 2-3 minutes to get your answer, but the source may be low quality. This may cause the answer to be wrong.

CPA Pilot can get you an accurate answer in less than a minute because it has access to authoritative sources fit for professional use at its fingertips. The difference is like giving CPA Pilot an open book test and ChatGPT trying to recall something it read a while ago.